- Home

- Keach Hagey

The King of Content

The King of Content Read online

Dedication

To Wesley, Belle, and June

Contents

Cover

Title Page

Dedication

Frontispiece

Prologue: “I Don’t Want to Sell Paramount”

Chapter 1: Rain at Sunrise

Chapter 2: The Conga Belt

Chapter 3: “The Whole Situation”

Chapter 4: The Next Generation

Chapter 5: National Amusements

Chapter 6: “From One Catastrophe to Another”

Chapter 7: “Artful Dealings”

Chapter 8: Forged in Fire

Chapter 9: Defeating the Viacomese

Chapter 10: Scaling Paramount

Chapter 11: Killer Diller

Chapter 12: Immortality

Chapter 13: “Remember, I’m in Control!”

Chapter 14: The Hotshot

Chapter 15: “Sumner in a Skirt”

Chapter 16: “This Is Crazy!”

Chapter 17: “Good Governance”

Chapter 18: Strange World

Chapter 19: “Our Family”

Chapter 20: “Sharp as a Tack”

Chapter 21: Sex and Steak

Chapter 22: Pandemonium

Chapter 23: “Cleaning House”

Epilogue: The First Female Media Mogul

Author’s Note

Acknowledgments

Bibliography

Notes

Index

About the Author

Copyright

About the Publisher

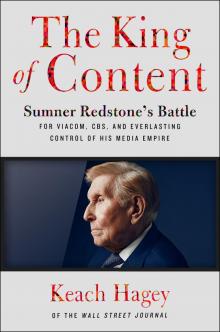

Frontispiece

Sumner Redstone with his daughter, Shari, in 2012. By 2018, Shari had ascended to the top of her family’s empire, becoming a media mogul in her own right. (Mark Sullivan/WireImage/Getty Images)

Prologue: “I Don’t Want to Sell Paramount”

One afternoon in February 2016, Viacom chief executive Philippe Dauman drove through the heavy metal gates of the exclusive Beverly Park neighborhood overlooking Beverly Hills, past the Olympian estates of movie stars like Sylvester Stallone and Eddie Murphy, and up to the sprawling, butter-colored mansion of his longtime boss and mentor, Sumner Redstone. Such visits had long been a monthly routine for the lifelong Manhattanite, who ran the New York–based public company that the ninety-two-year-old Sumner overwhelmingly controlled. Usually the two former lawyers would mix business talk with reminiscences of their past corporate conquests, watch a little baseball or CNBC, and gaze at the giant aquariums of Sumner’s beloved saltwater fish.

But on this day, Dauman had come to discuss a particularly delicate matter. Viacom was considering selling nearly half of Paramount Pictures, the glamorous Hollywood studio whose takeover in 1994 had defined both men’s careers. They had wrested it from rival media titans Barry Diller and John Malone in an epic bidding war, and owning America’s oldest continuously running studio—the home of The Godfather, Chinatown, and the Indiana Jones series—had cemented Sumner’s status as a mogul.

Yet Viacom’s stock had been in a tailspin, losing half its value during the previous two years, and investors were clamoring for some kind of dramatic action. Some big Chinese companies had gotten Hollywood’s attention in the last few months with their interest in studios, and it seemed like a good moment to capitalize on the century-old Paramount’s romantic allure—even if it, too, had been in a years-long slump. After one prospective buyer expressed interest in a deal that valued the beleaguered studio at more than $10 billion—more than twice what most analysts thought it was worth—Dauman wanted to explore a joint venture. Perhaps the right partner could not only provide the cash Paramount desperately needed to restock its nearly bare cupboard of franchises but also help the studio’s movies get better access to international markets in an era when 70 percent of Hollywood’s movie revenues came from overseas.

He knew it would be a hard pitch. Redstone was an amasser, not a divester, and few things had brought him greater pleasure over the last two decades than his intimate dinners at Dan Tana’s or The Ivy with Paramount’s management, albeit often at the inelegantly geriatric hour of five p.m. To own a studio in Hollywood was to be a king, a status beyond money. And Paramount was not just any studio. It was the original Hollywood monopoly, the creator of the studio system business model and the first studio to take Sumner seriously when he was nothing more than the executive vice president of his father’s drive-in theater chain.

Dauman’s task would also be challenging because communication with Sumner these days was nearly impossible. The mogul who had once famously declared that “Viacom is me” had suffered a precipitous decline in his health in eerie parallel with Viacom’s stock price, after an episode of inhaling food into his lungs in 2014 that had left him dependent on a feeding tube and barely able to speak. A few months earlier, his former live-in companion had alleged he was completely non compos mentis, unable to follow the thread of a conversation or the plot of a film. And a few months after this visit, Dauman himself would make a similar charge. But for now, he tried to communicate with Sumner the way he had been for months, by doing his best to interpret his grunts.

Often, visitors to the mansion got help deciphering Sumner’s speech from his nurse Jeremy Jagiello, dubbed “the Sumner whisperer.” But Dauman’s task was too sensitive for that. For months, he had assumed that the mansion was either bugged or filled with spies loyal to his longtime rival, Sumner’s daughter, Shari Redstone. Shari and Dauman, both sixty-one, had long competed for the role of Sumner’s heir apparent, but in recent years, Dauman seemed to have definitively clinched the prize as Shari’s relationship with her father deteriorated. That had all changed since the fall, however, when the two live-in companions half Sumner’s age to whom the mogul had bequeathed some $150 million (whom Shari referred to as her father’s “little sluts”) were thrown out of the mansion, paving the way for Shari to reconcile with her father. Dauman had been concerned enough about Shari that he had announced his visit when he was just twenty minutes away, in order to avoid giving his East Coast rival enough time to get on a plane and position herself next to her father through their meeting, just as Sumner’s former companions had done with all of Sumner’s visitors during the two years before their ejection. Still, he assumed—correctly—that anything Jagiello heard would be relayed back to Shari.

So as he walked in to find Sumner watching television in the “fish room,” the sitting room lined with aquarium-scale fish tanks, he asked Jagiello if he could step into the next room so that he and Sumner could discuss some sensitive corporate information. The nurses were not allowed to let Sumner out of their sight, in case they had to jump in and suction from his throat the saliva that was constantly threatening to choke him, but Jagiello moved through the open doorway between the aquariums. Dauman pulled a chair up next to Sumner, so that Jagiello could only see his back, and leaned in close to whisper his news. He asked Sumner if he had understood him, and Sumner nodded.

A few days later, Dauman held a board call to discuss the Paramount stake sale. Worried about leaks, he had not told anyone in advance, not even Paramount chairman Brad Grey, what the call was about. As he had expected, Jagiello had told Shari about the visit, the whispering and the nodding, and she called Dauman repeatedly in the hours leading up to the board call, worried about what machinations her rival was up to. But the call itself proceeded without drama. Dauman addressed the board members one by one, including Sumner and Shari, and got no objection from any of them.

The next day, Dauman announced that Viacom had received “indications of interest from potential partners seeking a strategic investment” in Paramount and had decided to pursue the discussions. In case any other potential partners were out there, the press release touted the studi

o’s deep library, “robust pipeline with proven franchises,” and “high potential” (read: nascent) television production operation. An undeniable For Sale sign had been planted in front of Paramount’s iconic Spanish Gate.

Anyone familiar with Sumner’s history was stunned. He was famously fickle about his executives, but Paramount was the love of his life. And, indeed, within a few days of the announcement, Sumner began repeating “I don’t want to sell Paramount” to anyone who would listen—to household staff, to Dauman over the phone, and finally, on Saturday, February 27, the day before the Oscars, to Grey, who wasn’t so thrilled about the idea himself. Still, at the next board meeting, which Sumner dialed into remotely, he voiced no opposition, and management charged ahead with the plan. Sumner’s protestations would not become public until April 11, when they were reported in the Wall Street Journal.1

Just how he came to utter this phrase is a matter of some dispute. Some people close to Viacom believe his household staff or some other ally of Shari’s goaded him into saying it by misinforming him that Viacom planned to sell the entire studio. Others think he was coached to repeat the phrase the way he repeated, parrot-like, other phrases like “Manuela is a fucking bitch” or “I kicked Shari out of the house” by people close to him who had an interest in having him say those things. Still others argue this was his own, authentic opinion.

Regardless of how they arrived on Sumner’s tongue, the impact of these six words was devastating and would become the fulcrum for one of the greatest corporate power struggles in American business history.

How had it come to this?

Sumner Murray Redstone, once feared as the “mad genius” of media who would dump his chief executive officers for mere wobbles in his companies’ stock price, had built one of the world’s greatest media empires through a series of audacious takeovers constructed to ensure that he always maintained control. Today, as the majority owner of the family theater chain National Amusements, he controls roughly 80 percent of the voting shares of both Viacom Inc. and CBS Corp., a $36 billion media empire encompassing MTV, Comedy Central, Nickelodeon, BET, VH1, Paramount Pictures, CBS, Showtime, Simon & Schuster, and the Showcase Cinemas and Cinema de Lux movie chains. He spent decades performing meticulous estate planning so that his control would extend beyond the grave (which he loved telling reporters he would never lie in), constructing trusts designed to make it impossible for his heirs to sell his companies after he dies. “Unless they start doing terribly,” he told the Wall Street Journal in 2012, “which they will not.”

Sumner’s confidence at the time was not misplaced. His life up to that point had been a story of exceeding expectations—starting as the son of a liquor wholesaler with underworld connections in the immigrant tenements of Boston’s West End to Harvard Law School and a federal clerkship, from the president of his father’s regional drive-in movie theater chain to the owner of Viacom, from a cerebral lawyer who shopped at Filene’s Basement to the owner of a coveted Hollywood studio, and ultimately, after the Viacom-CBS merger (the biggest media deal up to that point in U.S. history) to the controlling shareholder of one of the largest media empires in the world. Most famously, he had survived a hotel fire by hanging out a window while flames singed his wrist to the bone, an experience that left him with a gnarled claw for a hand, burns over 45 percent of his body, and a steely resolve never to be beaten at anything. That resolve made him the most feared negotiator in all of media. The credo that he coined and repeated for decades—“content is king”—turned out to be truer in the digital world than he could have ever guessed.

With the exception of Rupert Murdoch, no other titan of media so personally shaped the companies he controlled, at times swooping in to act as CEO when his frustration with management got too great. Like Murdoch, he had inherited a regional company from his father and turned it into a global behemoth. And like Murdoch, he sought to continue this control by passing it on to his children.

But the very ruthlessness that made Redstone a great businessman made him a terrible father. His relationship with his son, Brent, ended in 2006 when Brent sued him for unfairly shutting him out of the company and using the company as a private piggy bank. His relationship with his daughter, Shari, had run hot and cold for decades, at one point becoming so strained that they communicated only by fax. Other family members fared little better. Sumner had also squared off in court against his brother, Eddie; his nephew, Michael; his wife Phyllis; and his granddaughter Keryn. The theme running through much of the litigation was Sumner’s obsession for total control of the family business and his willingness to push aside anyone he had to, including—indeed, especially—his own flesh and blood, to get it.

But again and again, what threatened this control most was not his family but his tumultuous love life. When his philandering made his wife of fifty-two years, Phyllis, finally divorce him, he risked losing control of Viacom. And when he threw ex-companion Manuela Herzer out of his life, she turned around and filed a lawsuit challenging his mental capacity, a legal maneuver that would shake his media empire to its foundations. The case riveted Hollywood, in part because of the salacious details it leaked out about Sumner’s fixation on daily sex and steak, but mostly because it spoke to the industry’s deepest suspicions about why no one had seen or heard from Sumner in more than a year. When an activist investor started buying up Viacom stock that winter, he released a scathing PowerPoint presentation criticizing Dauman’s leadership, illustrated with stills from Weekend at Bernie’s, the 1989 comedy about two guys who drag their boss’s dead body around pretending he’s still alive so that they can continue to enjoy his luxurious home.

While CBS—bolstered by its sports rights and the programming prowess of its former actor CEO, Leslie Moonves—had been able to hold its stock price steady in the age of cord-cutting, Viacom’s fall had been dizzying. At the time of Dauman’s visit, ratings at its biggest cable networks, which include MTV, Comedy Central, Nickelodeon, BET, and VH1, had been falling double-digit percentages for years. A few small cable companies, annoyed at Viacom’s demands for price hikes for their entire package of dozens of channels when ratings were so weak, dropped them altogether in 2014—a move widely viewed as a canary in the industry coal mine. Revenues and profits had dropped in the previous twelve months, and hundreds of employees were laid off. One analyst compared Viacom to Eastman Kodak, the ultimate corporate cautionary tale, saying that both were “once dominant companies where the product that provides the majority of their profits (film; TV networks) is made obsolete by a digital world.”

Some of Viacom’s struggles in 2016 were happening because the television business was in the midst of seismic change. Subscription video services like Netflix, which allow people to avoid both advertising and expensive cable TV bills—the dual lifebloods of the cable television business that makes up the bulk of Viacom’s profits—were by this point in nearly half of American homes. The young audiences that had long been Viacom’s target viewers now watched video on Snapchat or YouTube instead of traditional TV, and they signed up for cable in ever-smaller numbers. Meanwhile, the industry was still having a hard time measuring the TV viewing that happens on iPhones and Roku boxes, which meant that Viacom had a hard time getting paid for its offerings.

But many media investors, analysts, and executives placed much of the blame for Viacom’s woes squarely at the feet of Dauman, a mergers and acquisitions lawyer who grabbed on to Redstone’s coattails in 1986 at the age of thirty-two and never let go. Compared to his ayahuasca-sipping predecessor, Tom Freston, who built MTV Networks into a global juggernaut and is beloved in Hollywood, the gold cuff link–sporting Dauman was never embraced by the creative community. Critics loved to point out that not a single one of Viacom’s biggest hits—things like Beavis and Butthead, Dora the Explorer, SpongeBob SquarePants, The Daily Show, and South Park—was developed since Dauman took the reins in 2006. While rival companies were investing in digital properties like Bleacher Report and Make

r Studios, Viacom under Dauman actively unwound its joint venture with Vice Media, which went on to become the most valuable digital media company at more than $5 billion. In the months before Dauman’s visit, Hollywood’s distaste for him had spread to Wall Street, with some of Viacom’s largest investors openly saying he lacked programming chops and the company would be better off without him. They were baffled how Sumner, who famously fired a string of CEOs before Freston, including Frank Biondi and Mel Karmazin, was putting up with Dauman’s performance.

It turns out that Dauman’s performance was not enough to get him fired. But his attempt to sell a piece of Paramount after Sumner asked him not to? That was disloyalty worthy of beheading. As Dauman drove away from the mansion that day, he didn’t know it yet, but he was a dead man walking.

Chapter 1

Rain at Sunrise

August 10, 1938: Darkness descended on what would prove to be an inauspicious beginning for a media empire.

It was opening night of the first drive-in theater in New York State. Rain drummed the domed metal roofs of the six hundred cars creeping through the mud of the abandoned airport along the Sunrise Highway in Valley Stream, Long Island, threatening to blur the picture and drown out the dialogue of the feature film the intrepid moviegoers had come to see: Start Cheering, an antic Columbia Pictures musical comedy starring Walter Connolly and Jimmy Durante about a film star who leaves Hollywood for college. Aside from some jelly-legged tap dancing by Hal Le Roy, a few cameos by the Three Stooges, and the spectacle of vaudevillian Chaz Chase eating a book of lit matches, the film didn’t have a lot to recommend it—not to mention that it had already been showing at indoor theaters for six months.

But as would often be the case for the drive-in industry for the next half century, the capacity crowd had come to the Sunrise Drive-In as much for the experience as for the movie itself. Coming in off the lonely stretch of highway along the railroad tracks just beyond the New York City limits, they had driven past the glowing marquee beckoning drivers to “Sit in Your Car” and “See and Hear the Movies” for thirty-five cents, past the scrubby evergreens planted to keep outsiders from stealing a glimpse of the screen, past the five-story steel-and-concrete screen splashed with turquoise and terra-cotta. At the entrance, fresh-faced young men in pale jackets, black bow ties, and soda jerk hats guided the cars to their place in the concentric semicircular ramps tilted to ensure that no one’s Chevy, no matter how big or boxy, blocked anyone else’s view. These same young attendants went from car to car, delivering refreshments from enormous wooden boxes slung over their shoulders. For weeks leading up to the premiere, the theater’s developers, the New York architectural and building firm led by Irwin Chanin, had been in the news, touting their latest creation as if it were the eighth wonder of the world.1 The Chanin Organization was already well known for building architectural marvels in Midtown Manhattan, such as the sumptuous Roxy Theatre, one of the largest movie houses in the world when it was completed in 1927, and the Art Deco landmark Chanin Building, the tallest building in Manhattan when it was finished in 1928. So when they turned their public relations machine to promoting the twelve-acre drive-in theater they had carved out of their vast Green Acres suburban housing development, it wasn’t hard for them to get most of the press to print that their sixty-by-forty-eight-foot screen was “said to be the largest ever made” and “on the basis of ground area it may be considered the ‘largest’ theater in the New York area.”2 “World’s Biggest Movie Screen for Outdoor Theater,” blared a headline in Popular Science, beneath a photograph of a man standing, for scale, like a tiny speck in front of an Art Deco ziggurat.3

The King of Content

The King of Content